Originality makes business more valuable.

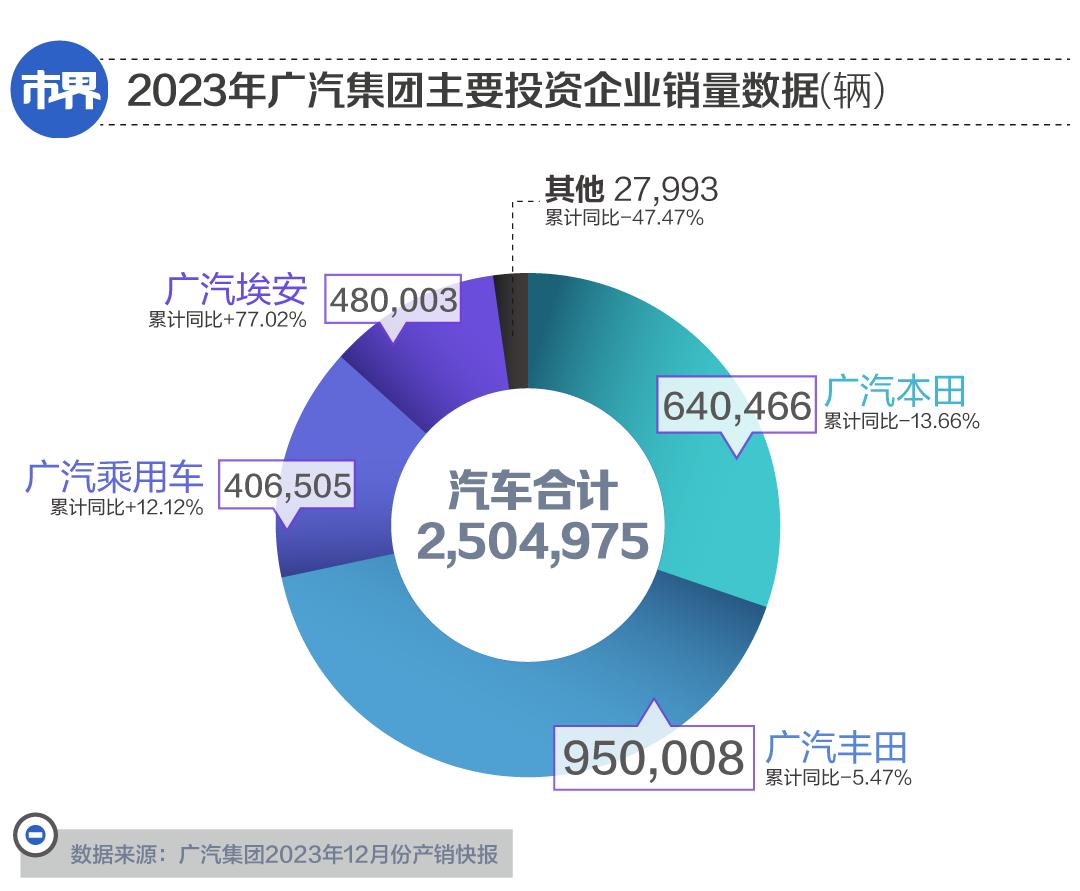

Within Guangzhou Automobile Group, Ai ‘an is a heavyweight. It was born with a golden key, and took the lead in completing mixed reform, employee equity incentive and introducing strategic investors. In 2023, the sales volume of Aeon exceeded 480,000, catching up with Guangfeng and Guangben in the group. As the vanguard of the transformation of domestic super-large car companies in the new energy era, Ai ‘an has a heavy responsibility and challenges.

Author | Yang Qiao

Editor | Tian Yanlin

Operation | Liu Shan

Can super-large traditional car companies continue to stand in the era of new energy vehicles through the cycle?

Compared with the new energy sub-brands hatched by traditional car companies such as FAW, SAIC and BAIC, in 2023, Ai ‘an, a new energy brand under Guangzhou Automobile Group, was regarded as "the most beautiful child in this street" in terms of sales volume. According to the ranking of retail sales of new energy manufacturers published by the Federation of Riders, in 2023, GAC Ai ‘an surpassed 483,000 vehicles, second only to BYD and Tesla China. If we compete separately for the annual sales growth, the growth rate of 77% of GAC Ai ‘an is even higher than that of BYD’s 61.9%.

However, in January, 2024, the sales volume of Egypt’s safety balls dropped by over 45% from the previous month, with a total of only 24,947 vehicles, which was surpassed by AITO and LI. This is related to the relatively fierce price reduction sprint of car companies in December last year, which caused the overdraft of the whole market. However, it can also be seen that the new energy vehicle market in China is really getting bigger and bigger.

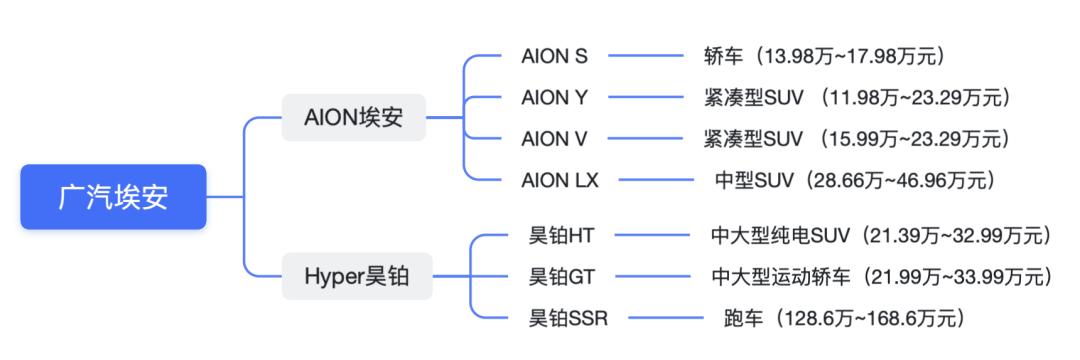

As a pioneer in testing new energy sources for traditional car companies, GAC Ai ‘an wants to break through in the new year, and it has to achieve a breakthrough in the sales of high-end brands-Haoplatinum on the basis of maintaining the high growth rate of two low-end models, Ai ‘an S and Ai ‘an Y, which is full of challenges.

▲ (Source/Multiplication Association)

"the king of the network car"

In 2017, the new car-making forces drew a clear line with "PPT car-making", and it was also the second year that Ceng Qinghong, a vicious person in the car circle, took charge of Guangzhou Automobile Group and became the chairman of the group.

That year, Yu Chengdong was still shouting hard in the mobile phone circle, and Guangzhou Automobile Group had decided to separate the new energy business and set up Guangzhou Automobile New Energy Automobile Co., Ltd. (hereinafter referred to as "Guangzhou Automobile New Energy Company") in July of that year.

In April 2018, GAC New Energy Company participated in beijing international automotive exhibition, and launched the pure electric SUV GE3 and other models, but it was a pity that it failed. At the end of the year, the indomitable GAC New Energy Company released the first compact SUV—— with the brand name of "Ai ‘an"-Ai ‘an S, which went offline in the factory in April 2019 and officially went on sale in May.

At the beginning of the transformation of the new energy track, GAC had a failed experience. In order to seize the market share, Aeon S must find a breakthrough.

At that time, the rental category of new energy passenger cars reached its peak, accounting for 27%. As a result, Ai ‘an S aimed at the B-end market and provided customized models at a price of 139,800 ~ 192,800 yuan. In 2019, the sales volume of GAC New Energy Company exceeded 40,000 vehicles, which doubled year-on-year. Ian s won the first prize and contributed 32,000 vehicles.

In November 2020, Guangzhou Automobile Group simply renamed "Guangzhou Automobile New Energy Company" as "Guangzhou Automobile Ai ‘an" and announced its independent operation. Later, after the launch of Ai ‘an Y, together with Ai ‘an S, it became the favorite of network car owners. Guangzhou Automobile Ai ‘an is also dubbed by netizens as a new energy automobile brand that "knows the middle-aged unemployed best".

Before Ai ‘an was born, BYD had been promoting the taxi market for nearly ten years, and its Dynasty series models also enjoyed sufficient voice in the new energy network car market.

Therefore, on the day when Ai ‘an won the first stage, the outside world put it on both ends of the scale with BYD.

Zhang Yi, CEO of Ai Media Consulting, told the "City Circle" that BYD’s success lies in mastering the competitiveness of core technologies such as batteries, and grasping a very good new energy development trend, controlling the cost and taking the lead, and improving the overall profit margin of automobile manufacturing.

The three electric (motor, battery, electronic control) systems of Ai ‘an were originally adopted by other companies. Its motor and electronic control system are made of parts from Nippon Denko and GAC Nideco, and GAC Nideco is a joint venture between Nippon Denko and GAC Holding Company. On the power battery, Contemporary Amperex Technology Co., Limited and Zhongchuang Singapore Airlines are all suppliers of Aeon.

In October 2021, Ai ‘an embarked on the road of BYD’s self-production and self-research, and planned to invest in the trial production line of self-developed batteries. In the second half of 2022, with the support of Guangzhou Automobile Group, Ai ‘an successively established Yinpai Battery Technology and Ruipai Power Technology to accelerate the layout of the electrified industrial chain.

In addition, on the product side, in January, 2023, BYD launched its high-end car brand-Looking Up, a pure electric supercar looking up at U8, with a price of millions. In October of the same year, Haobo Hyper SSR was officially listed, which is also a pure electric sports car. The manufacturer’s guide price is 1.286 million to 1.686 million yuan.

▲ (Source/car home. Cartography/city boundary)

What makes Ian uncomfortable is that the million-class sports car has been on the market for several months at night, and it was almost misunderstood by the outside world as running after BYD.

You know, in September 2022, it was ——Hyper Haobo, a high-end automobile brand released by Ai ‘an, and the first new car super-running Hyper SSR also appeared simultaneously. Byd officially named its high-end car brand in November 2022-looking up.

Whether it is Ai ‘an or BYD, at this stage, millions of sports cars may be more famous than profitable. For Ai ‘an, the main battlefield with BYD is still in a cheap car of 100,000 ~ 200,000 yuan.

Therefore, in 2023, Ai ‘an sold cars crazily. It has been reported by the media before that the rebate of a car from Ai ‘an to the dealer can make the other party earn more than 20,000 yuan. However, new energy car companies are too big. At the end of 2023, BYD took the lead in price reduction promotion, and Ai ‘an also worked hard. Unfortunately, it failed to achieve the goal of selling 500,000 vehicles annually.

In recent years, GAC Ai ‘an has been unable to escape the shadow of BYD, and every move is considered to be crossing the river by touching BYD.

Recently, a secondary dealer of Ai ‘an in Chongqing told the "City Boundary" that there were only a few 4S stores in Ai ‘an before, and in order to expand the distribution channels, it suddenly increased to more than ten in 2023.

In order to encourage dealers to actively sell cars, manufacturers promise that as long as they complete the sales of more than a dozen cars every month, they can get the decoration subsidy for the previous shop, which will be replenished in two years. At the same time, according to the above dealers, Ai ‘an asked for the location of the exhibition hall: there must be a BYD store next to it.

According to the dealer, the original exhibition hall was not approved because there was no BYD store next to it.

Ian, is this going after BYD? "City Boundary" also consulted the staff of another Chongqing Ai ‘an Experience Center. "It doesn’t have to be BYD next to it. It can only be said that BYD is a direct competitor of Ai ‘an, and of course it is the best." At present, next to the Ai ‘anmen store where he is located, there is BYD.

However, dealers in Shijiazhuang, Guangxi, Shandong and other places said that to join Ai ‘an, manufacturers did not ask to be next to BYD.

IPO is more urgent.

Perhaps the feedback from Chongqing dealers is just an example, but they are right in one sentence. BYD is a direct competitor of Ai ‘an.

But after all, BYD has worked in the field of new energy vehicles for many years, and its family has a big business. In front of Ai ‘an, there are only two brands: "AION Ai ‘an+Hyper Haobo". If it wants to master more discourse power, it must let itself stay at the new energy table for a little longer.

Even with his back to Guangzhou Automobile Group, Ai ‘an is far from being able to sit back and relax. Compared with BYD, "Wei Xiaoli" and Zero Run, Ai ‘an lacks a capital market pass. And this is too important for the car-making business that burns money crazily.

During the 2023 Shanghai Auto Show, Feng Xingya, general manager of Guangzhou Automobile Group, said that he would strive to complete the IPO in 2023. At that time, it was reported in the market that GAC Aian might submit the application materials for listing to the relevant departments at the end of June, and according to the plan, it would seek listing in science and technology innovation board. But soon, Guangzhou Automobile Group said that the listed sector had not been confirmed.

It seems that the time has not yet come to this young master who was born with a golden spoon. After a lapse of nine months, at the beginning of 2024, many media reported that Guangzhou Automobile Group planned to spin off the Ai ‘an brand and arrange its listing in Hong Kong, raising $1 billion.

Up to now, regarding the rumors of IPO in Hong Kong, Ai ‘an has not expressed his position.

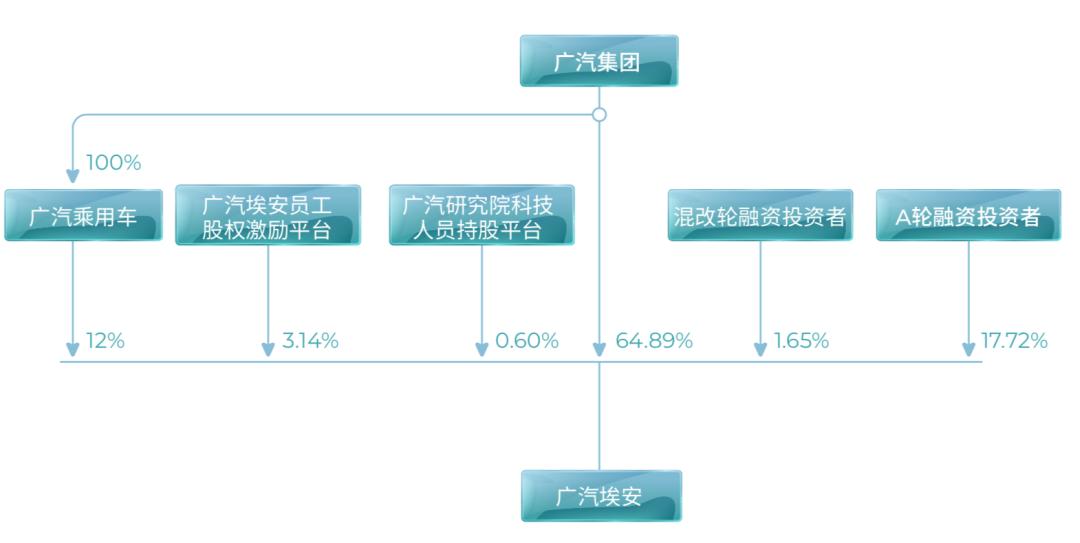

As early as August 2021, under the arrangement of Guangzhou Automobile Group, Ai ‘an started the mixed reform and war-leading work. The group generously took out 7.404 billion yuan in cash, and also let Guangzhou Automobile Passenger Car give Ai ‘an 3.557 billion yuan in physical assets, and distributed more than 600 people from Guangzhou Automobile Research Institute and some patents to Ai ‘an. In November of the same year, GAC Aian completed the reorganization and integration of relevant R&D personnel, intangible assets and fixed assets in the field of pure electric new energy vehicles.

In March, 2022, GAC Ai ‘an implemented equity incentives for 794 key employees by means of non-public agreement to increase capital. The capital increase totaled 2.566 billion yuan. According to media reports, the enthusiasm of internal employees to subscribe is very high, and even some employees borrow money from banks to subscribe. Gu Huinan, the general manager of Ai ‘an, even mortgaged the house and invested 20 million yuan.

In September of the same year, Ai ‘an completed the shareholding system reform; In October, Ai ‘an completed the A round of financing, and the total financing of 53 strategic investors was 18.294 billion yuan, releasing 17.72% of the shares. Guangzhou Automobile Group’s direct and indirect total shareholding in Guangzhou Automobile Ai ‘an changed from 93.45% to 76.89%, and it is still the controlling party.

The valuation of Ai ‘an soared to 100 billion yuan in an instant, which was about equal to the market value of two Xpeng Motors at that time, making it the largest unicorn enterprise among unlisted new energy vehicle companies.

▲ (Guangzhou Automobile Aian Equity Structure Diagram. Tuyuan/Guangzhou Automobile Group Financial Report)

Guangzhou Automobile Group is very much looking forward to the listing of Ai ‘an.

Within Guangzhou Automobile Group, Aeon is a heavyweight, and more than 90% of the group’s overall new energy sales are supported by Aeon. Although joint ventures GAC Toyota and Guangqi Honda also have new energy vehicles, they can’t count on hard sales.

In October, 2022, Guangzhou Automobile Group revealed in the progress announcement of capital increase and share expansion in Ai ‘an: Guangzhou Automobile Ai ‘an is the development carrier of Guangzhou Automobile Group’s intelligent pure electric new energy automobile industry, and has successively launched a number of intelligent pure electric new energy automobile products such as AION S, AION LX, AION V, AION Y and Hyper SSR.

On January 8, 2024, in the e-interaction of SSE, some investors asked about the listing progress of Ai ‘an. Guangzhou Automobile Group said that related projects are progressing as planned. "Even if the subsequent listing of Guangzhou Automobile Ai ‘an is successful, Guangzhou Automobile Group (including the shares held by its subsidiaries) will still be the controlling shareholder of Guangzhou Automobile Ai ‘an, and the income of Guangzhou Automobile Ai ‘an will also be incorporated into the statements of the listed company Guangzhou Automobile Group. In the future, with the growth of Guangzhou Automobile Ai ‘an, Guangzhou Automobile Group will also benefit. "

In the eyes of the industry, A-shares have higher requirements for corporate profitability and innovation attributes when the capital market is experiencing a cold winter and the IPO is tightening. And listing in Hong Kong stocks is easier than listing in A-share science and technology innovation board. However, Dennis Huang, president of Huisheng International Capital, told the "Market Boundary" that there are differences in investor composition, valuation system and market expectation between the A-share market and the Hong Kong stock market, and the valuation of enterprises may be affected if they switch from A-share science and technology innovation board to Hong Kong stock market.

Ai ‘an’s IPO trip to Hong Kong has not yet landed, but the products have been laid out in Hong Kong first.

On January 28th, GAC Aeon announced its official entry into the Hong Kong market, and the first store in Kowloon Bay in Hong Kong officially opened. At the product launch conference, Ai ‘an brought the first model AION Y Plus, and also appeared in models such as Haoplatinum HT and Haoplatinum SSR.

According to Guangzhou Automobile Ai ‘an, it is the first automobile enterprise to lay out more than 300 1000V super-filled piles in Hong Kong. In 2024, it will build six sales service centers and brand direct stores in Hong Kong.

Before it, new energy brands such as BYD, Tesla, SAIC Chase, SAIC MG and Great Wall Euler all entered the Hong Kong market. However, except for Tesla’s direct marketing system, most of them are sold by local agents.

Self-explanation

Will Ian choose to list in Hong Kong? How many problems can listing help it solve? It is not known yet. But at the moment, there are some problems that need to be proved.

A few years before and after the launch of Ai ‘an S, BYD’s Dynasty Series, BAIC New Energy, Geely Geometry, etc. all launched products that were very close to their prices and product positioning, but they failed to shake Ai ‘an’s position as the "king of network car".

And this has also brought hidden concerns to Ai ‘an.

From 2020 to 2022, the proportion of pure electric rental decreased from 15% to 11%. Since then, the market demand has gradually strengthened to private consumption. In November 2023, the proportion of rental was only 7.3%, reaching the lowest point of the year.

It is widely believed that Ai ‘an, which relies on the network car market, will decline with the market saturation. Moreover, the label of "the king of the network car" in the past will also hinder it from launching the C-end market through high-end models.

It is estimated that Ai ‘an also heard the comments from the outside world. Before the launch of the high-end brand Hyper Haobo in September 2022, he began to adjust the sales structure and tried to find a balance point.

According to the data of CITIC Securities, from 2020 to the first half of 2021, Ai ‘an has a high proportion of leasing in the B-end market, which is about 60%~70%. However, at the 2022 performance meeting, Guangzhou Automobile Group publicly stated that in the sales system, the overall sales volume of its C-end has increased to 70%~80%.

However, don’t look at the gradual saturation of the online car market. In the past year, the competition of 100,000 and 150,000 "online car models" has become more intense.

On December 12th, 2023, Q05, the third new car of Changan Qiyuan, went on the market, with a starting price of 119,900 yuan. Subsequently, some dealers played the slogan of Changan Qiyuan A05 "100,000-class network car first choice". Earlier, Xpeng Motors announced that the new brand of pure electric car "MONA", which is strategically cooperated with Didi, will start mass production in 2024, and the first product will be priced at about 150,000 yuan, which refers to the online car market.

Ian is under pressure. Before, they sold it to corporate customers who were engaged in online car rental at B-end, and now they are trying to attract C-end users. Ian said that if users buy a car and intend to engage in online car business or home use, the insurance and maintenance measures given by manufacturers are also different.

"Don’t underestimate the B-end market, and don’t think that the B-end market is Low." The management of Ai ‘an has publicly stated. Just as people can never forget where they come from, Ian has not chosen to forget the glory brought by the online car market.

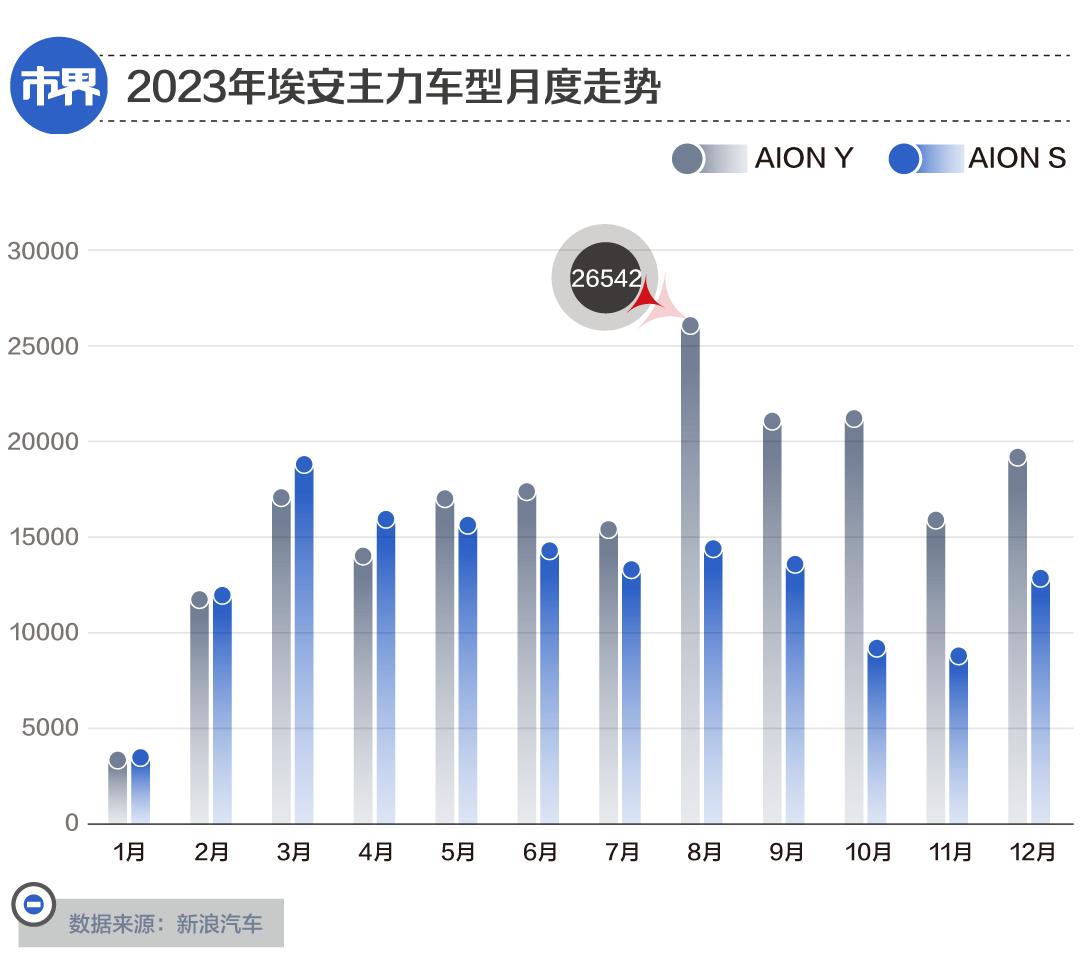

Nevertheless, combing the monthly sales data of the past year, the "city boundary" found that in 2023, the sales of the two models, Ai ‘an S and Ai ‘an Y, totaled more than 350,000 vehicles, accounting for more than 75% of the annual sales of Ai ‘an Safety.

After the sales data in February and March of 2023 reached 40,000 vehicles, the overall sales volume of Ai ‘an began to grow weakly in May. Until August, the monthly sales volume hovered around 45,000 vehicles. In September, the monthly sales volume reached 50,000 vehicles, and then fell again.

According to the statistics of Sina Automobile, the monthly sales of the main model, Ai ‘an S, reached a high of 18,903 vehicles in March 2023, with a transaction price of 157,900 yuan. From April to July, the transaction price decreased and the sales volume continued to decline. Sales briefly rebounded to 14,801 vehicles in August, but continued to decline from September to November. In December, the year-end sprint, the monthly sales of Ai ‘an S failed to catch up with August and September.

The overall sales volume of Ai ‘an Y is better than that of Ai ‘an S, with an average monthly sales volume of 17,000 vehicles in the past year. Although it is much better than the competitors of Volkswagen ID.3, Zero Run C11 and Galaxy L7, it failed to achieve the average monthly sales volume of 22,000 vehicles of BYD Qin Plus DM-I..

Let’s look at the Haobo brand that Ai ‘an impacts the mid-to-high-end market. It has three models: medium and large coupe Haobo GT, pure electric luxury supercar Haobo SSR and medium and large pure electric SUV Haobo HT. In 2023, the cumulative sales volume of Haobo brand was 8087 vehicles. Among them, the representative model, Haobo GT, was listed for the first time on July 3 last year, and the retail sales announced by the Association averaged several hundred units per month; After the listing of Haobo HT in November last year, its monthly sales exceeded 1,000 units.

In the face of the industry’s doubts about the slowdown in its low-end sales and the obstruction in rushing to the high-end, Gu Huinan said in an interview with 21st century business herald on January 30 that the LOGO of Haobo was really approved in June 2023, and it has just passed half a year. "(Think) high-end brands want to rush to high-end people in half a year, and they lack some understanding of the industry."

Indeed, it takes time for the brand to grow, but looking at the increasingly rolling new energy vehicle market in 2024 and the friends who are also making progress, Ai ‘an should seize the time to prove himself.

Originally produced in the city, please do not reprint it without authorization.

E-mail for communication suggestions: gaojian@boyamedia.com

Unless otherwise specified, the pictures are all from vision.

Original title: "Guangzhou Automobile Ai ‘an, Chasing BYD"

Read the original text