CCTV News:Recently, State Taxation Administration of The People’s Republic of China and the Ministry of Natural Resources jointly issued the Notice on Further Deepening Information Sharing to Facilitate Real Estate Registration and Taxing, demanding deepening departmental information sharing and vigorously promoting "one window to handle affairs".

According to the circular, the tax authorities and natural resources authorities should base themselves on the actual situation of local informatization construction, closely strengthen cooperation, take solving practical problems as the guide, reasonably determine the information sharing mode, and realize real-time sharing in time.

Before the end of 2022, the tax authorities and natural resources authorities of all cities and counties in China should realize real-time sharing of the whole process information of tax-related business of real estate registration.

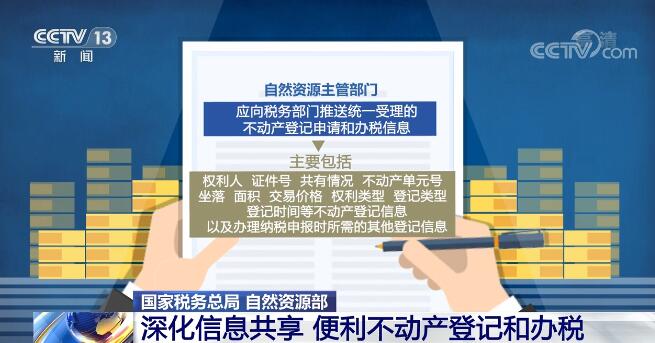

The competent department of natural resources should push the uniformly accepted application for real estate registration and tax information to the tax authorities. It mainly includes real estate registration information such as obligee, certificate number, co-ownership, real estate unit number, location, area, transaction price, right type, registration type and registration time, as well as other registration information required for tax declaration.

The tax department should push the tax payment information to the competent department of natural resources. It mainly includes the taxpayer’s name, certificate number, real estate unit number, whether the tax has been paid, the time of tax payment, and other tax payment information required for real estate registration.

According to the circular, the tax authorities and natural resources authorities should vigorously promote the online and offline "one-window service" supported by information technology. Before the end of 2022, all cities and counties in the country should realize the "one window to do things" under the real estate registration and taxation line; Before the end of 2023, all cities and counties across the country will strive to achieve "online (handheld) handling" of real estate registration and taxation.