Original, Wang Xiaoyu, Tiger Sniff APP

Produced | Tiger Sniff Car Group

Author | Wang Xiaoyu

Edit | Thoughtful

Headshot | Visual China

"If an energy liquid can fill a car in five minutes and has a range of more than 600 kilometers, is the new energy electric vehicle no advantage?" This is a question on Zhihu that has more than 5 million views, and the answer with more than 4,000 likes at the bottom reads: "The liquid you mentioned is now eight dollars a liter."

As the subject wishes, in the current car market, the battery is indeed not dry enough for the fuel tank.

On July 1, the new car-making forces handed over the monthly sales report card on time. Among them, Li Auto topped the list with 32,000 units, followed by 13,000 units with zero running, and then Nezha’s 12,000 units. Then the competition for the fourth and fifth places was somewhat anxious. NIO narrowly beat JK’s 10,620 units with 10,707 units.

The reason why the top three won without suspense is all due to the "magical energy liquid" – gasoline. At present, the three cars sold by Li Auto are all extended-range electric vehicles. Zero Run and Nezha have added extended-range models to the pure electric product array since this year, and then monthly sales have stabilized at a level of more than 10,000. The "dying" Skyworth car also became entrenched after the launch of the extended-range version.

Those new brands that honestly make pure electric vehicles have mediocre deliveries. Like the bottom three – Avita, Jichu, and Zhiji are all pure electric models sold, with monthly deliveries of less than 2,000 units.

Losing the battery to the fuel tank, is it really bad money driving out good money?

Extended range plays the leading role, it’s really "see you for a long time"

Extended-range electric vehicles are scolded by those who understand cars, and those who buy cars say they are fragrant. Once praised by traditional car companies as a backward technology of "taking off your pants and farting", it has now become a wonderful way for new car-making forces to "climb high branches".

From the perspective of the overall sales performance in the first half of this year, Li Auto became the biggest winner. The delivery volume in the first half of the year reached 139,100 units, which exceeded its delivery volume in 2022. Compared with the same period, it increased by as much as 130.31%. In contrast, NIO accumulated 54,600 units in the first half of the year, while Xiaopeng accumulated 41,000 units. This means that only pure electric NIO and Xiaopeng have not achieved the ideal of only selling extended range.

The sales secrets of "Extended Range", who is not confused.

After eight years of pure electric vehicles, Nezha Automobile also launched the Nezha S extended range version at the end of last year. In the official order statistics released at the time, 62% of users chose the extended range model. At the beginning, Nezha’s intention was to use the extended range technology route that is close to the habits of fuel vehicles to seize the fuel vehicle market.

Zero Run, which used to rely on the micro pure electric market, released the C11 extended range version in February this year, maintained a high monthly growth rate in the following months, and surpassed Nezha in June to become the second. According to the plan, Zero Run’s C01 will also launch an extended range version in the second half of this year, and the future Zero Run’s B product line will also release a pure electric + extended range dual version.

This year, the extended-range team will continue to expand.

According to blogger @Laoqi, the number of new and old brands that are ready to engage in extended range and have planned to develop extended range models is beyond imagination. Li Xiang, CEO of Li Auto, forwarded this Weibo and wrote: "Mainly by looking at which brand headhunters are contacting our corresponding teams, we will know who is really doing extended range."

According to people familiar with the matter, "Xiaomi has been recruiting people from the ideal recently, and there is a high probability that it will also increase the range."

Huawei, which entered the car industry earlier than Xiaomi, is even more of a fan of extended range. Yu Chengdong, executive director of Huawei, CEO of end point BG, and CEO of smart car solutions BU, once stated that it is better to buy a fuel car than an extended range car. In Yu Chengdong’s opinion, extended range electric vehicles are usually used as gasoline vehicles, and the fuel consumption per 100 kilometers is five or six liters, which is more than half of the Porsche Cayenne he drove before, but the acceleration performance is much higher than the Cayenne, that is, "half the fuel consumption, double the acceleration performance".

Avita, which is jointly named by Changan, Huawei and Ningde Times, is also concerned about the "fuel tank". Recently, according to the website of the State Intellectual Property Office, Avita Technology (Chongqing) Co., Ltd. has published a patent called "a kind of fuel tank sealing structure and automobile". At present, Avita’s models on sale are all pure electric, and the appearance of this patent indicates that the "extended range version" of Avita is not far away.

Range extension is popular, and pure electricity continues to dormant. Has the current new energy vehicle market really become "bad money drives out good money"?

The battery loses to the fuel tank, and bad money drives out good money?

When it comes to fuel tanks, we must first talk about BYD.

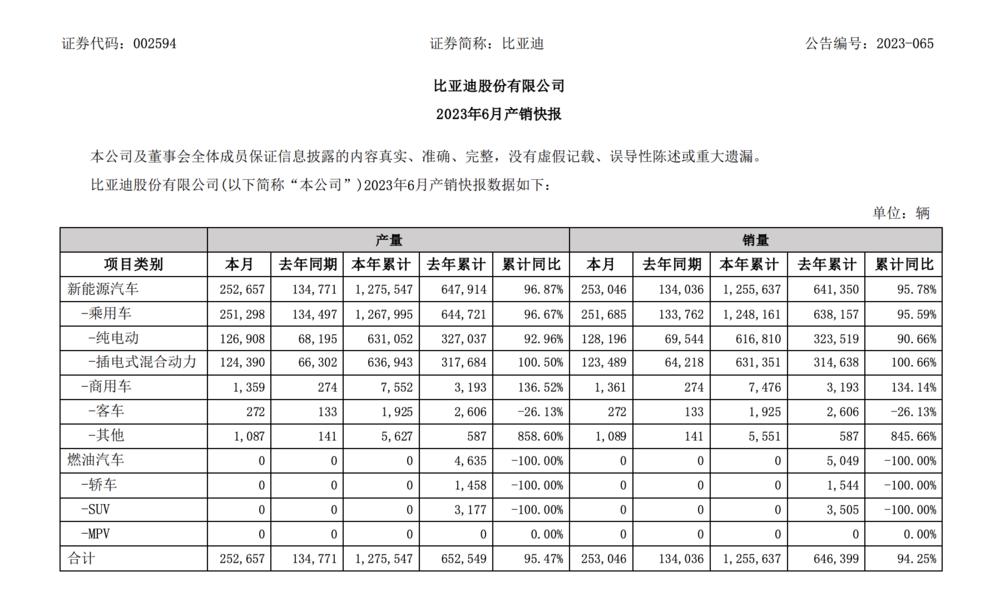

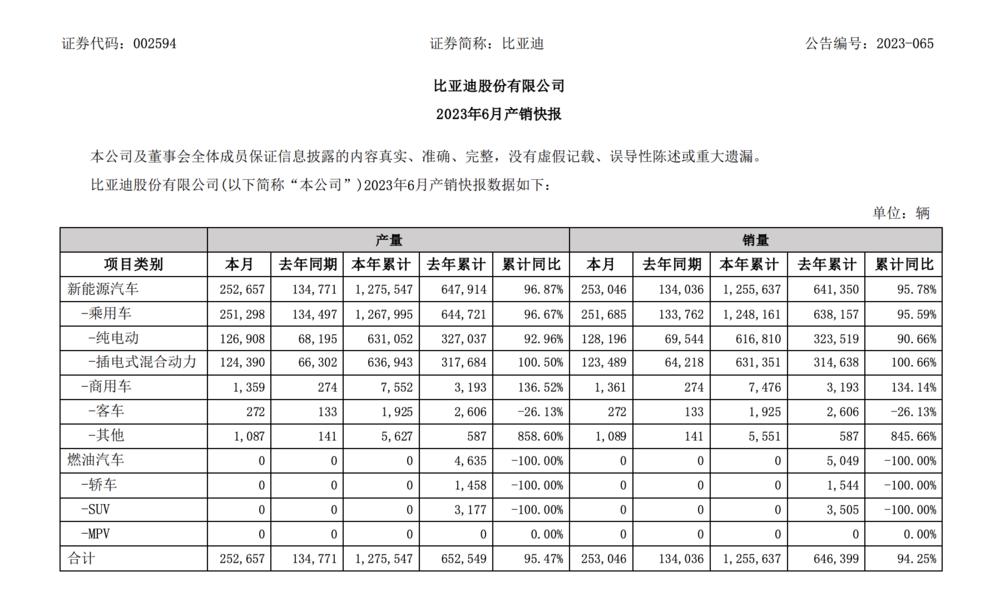

On July 2, BYD announced its sales results for June: 253,046 new energy vehicles were sold, an increase of 88.79% year-on-year; from January to June, the cumulative sales of new energy vehicles were 1,255,637, an increase of 95.78% year-on-year.

Judging from the sales volume of the month, pure electric and plug-in hybrid are almost equally divided, and pure electric only sold 4,707 more units than plug-in hybrid. But from the cumulative sales volume this year, plug-in hybrid models are higher than pure electric models, and the difference is 14,500 units.

From a longer perspective, the contribution of BYD hybrid models to total sales is slightly higher than that of pure electric models.

Range extension is essentially a type of hybrid.

The extended-range electric vehicle belongs to the "series hybrid" branch, and the core components are the fuel engine, generator and drive motor. The engine does not directly participate in the vehicle’s drive, but transmits power to the motor, which generates electricity again, thereby driving the vehicle. Therefore, the extended-range electric vehicle is more like a pure electric vehicle, bringing a "power bank" composed of engine + fuel tank.

However, due to the fact that the extended range does not have a direct-drive drive mode of the engine and generally has high fuel consumption at high speeds, many traditional fuel vehicle manufacturers believe that the extended range is a backward technology for taking off pants and farting. In order to show their technical strength, the vast majority of manufacturers will focus on "series-parallel hybrid" models – its biggest advantage is low fuel consumption and high performance.

Unlike the extended range type, the series-parallel hybrid power structure is more complex and delicate, capable of not only pure electric, direct drive, and series connection, but also of parallel connection when power is required. The engine and motor drive the vehicle together, generating powerful power. Hundreds of thousands of hybrid cars can rival the power output of 2.5T and 3.0T fuel vehicles.

BYD’s million-dollar "luxury car" – looking up at the U8, was implied by Li Xiang to use the extended range

But embarrassingly, except for BYD, it is difficult to "eliminate the range extension" of other brands’ plug-in models.

For example, Great Wall Motors sold 26,643 new energy vehicles in June. Among them, Haval brand new energy vehicles sold 10,026, and the recently launched Xiaolong series sold 6,098; Euler brand sold 10,015; Wei brand new energy sold 6,602. From January to June this year, Great Wall Motors sold more than 93,000 new energy vehicles – adding Great Wall’s hybrid and pure electricity, it did not sell the ideal "extended range".

There is no doubt that the extended-range electric vehicle is not as sophisticated as the series-parallel hybrid technology in terms of technology, and it is not as valuable as the pure electric model in terms of long-term layout in terms of trend. But the trick of the extended-range electric vehicle is that the user education cost is low.

When promoting "series and parallel hybrid technology", many sales need to first popularize with customers what "series and parallel" is, then tell them "why it saves fuel and why it has strong power", and then popularize "what is the first, second, and third DHT". When the sales confidently say a lot of words, the customer is basically in a state of "brain CPU burning".

However, when it comes to the extended-range electric vehicle, the sales only need to tell the user one sentence: "This car should be driven by pure electricity in the city, and the high-speed one should be driven by oil. If you have the conditions, install the charging pile, and if you have no conditions, you can directly refuel."

For the rest of the sales process, you only need to take the user to touch the "refrigerator color TV big sofa", the child is happy and the wife is satisfied, and this order is basically completed.

Although the range increase is good, don’t be greedy for cups

Extended-range technology can be used as a "stepping stone" for new car makers to enter the market, but it cannot be used as the only technical path for car companies to survive. The reason why it is said to be a "stepping stone" is mainly because the threshold is low and the profit is high.

Through the "fuel tank + small battery" approach, the extended range solves the shortcomings of pure electric vehicles in terms of range. For example, pure electric vehicles may need to stack 150 kWh battery packs to achieve a range of 1,000 kilometers, but the extended range can easily achieve a comprehensive range of nearly 1,000 kilometers. Not only is the range anxiety gone, but the cost of the whole vehicle has also dropped significantly.

How expensive is a large-capacity battery? It is no exaggeration to say that a large battery can buy a car. Qin Lihong, co-founder and president of NIO, once said that the cost of a 150 kWh battery is very high, and the cost is equivalent to an ET5 (starting at 298,000 yuan).

Taking Changan Deep Blue S7 as an example, the cheapest extended range version is only 149,900 yuan, while the cheapest pure electric version is 189,900 yuan; the extended range CLTC has a comprehensive battery life of 1040km, while the pure electric CLTC has a battery life of 520km. In many similar "dual power forms" of products, in addition to meeting the needs of restricted cities, the purpose of the pure electric version is more like to highlight how great the extended range version is.

More interestingly, "experts" agree that Range Extension will have its "best years".

In January this year, the "China Extended Range Electric Vehicle Industry Development Report" released by the China Association of Automobile Manufacturers predicted that the sales of extended-range electric vehicles are expected to exceed 500,000 in 2025. The compound growth rate from 2020 to 2025 is expected to reach more than 60%. In terms of ownership, it is predicted that by 2025, the number of domestic extended-range electric vehicles is expected to reach 1.10 million – 1.30 million, and the optimistic estimate may exceed 1.50 million.

However, the "extended-range fan" Ideal has already started to turn the bow – Li Auto’s first 5C pure electric super flagship model, Ideal MEGA will be released in the fourth quarter. By 2025, Ideal will form a product matrix of "one super flagship model, five extended-range electric models and five pure electric models". By then, the number of ideal pure electric models will exceed the number of extended-range models.

"Looking back five years, extended range is still the best solution for SUVs," Li said on Li Auto’s second-quarter 2022 earnings call about mid- to long-term product planning.

Perhaps five years is just the transition period for extended-range electric vehicles.

Write at the end

To make an inappropriate metaphor, a swarm of extended range is a bit like a swarm of PHS back then.

At the end of the 20th century, China Telecom launched PHS, with annual sales revenue as high as 10 billion yuan. Many companies have seen the profits here and submitted plans to carry out PHS business.

Huawei’s management was no exception at the time, but Ren Zhengfei unexpectedly rejected the plan. The reason given was that PHS was destined to be a short-lived transitional technology, and 3G was the future. Missing PHS would have cost Huawei a large chunk of profits, but missing 3G would have affected Huawei’s process of becoming a great enterprise. This is a fundamental misstep.

Looking at the entire automotive industry, there are very few car companies that can "not be greedy for short-term sales and adhere to long-term principles". The vast majority of car companies are either "extended range + pure electricity", "hybrid + pure electricity", or through different sub-brands to cover a variety of energy driving methods. Tesla may be the only one that only does pure electric and has a considerable sales volume.

On July 3, Tesla released the global production and delivery report for the second quarter of 2023. The report shows that Tesla delivered more than 466,000 vehicles to global customers in the second quarter, an increase of 83% year-on-year, setting a new quarterly delivery high. Combined with the first quarter performance, Tesla delivered nearly 900,000 vehicles in the first half of the year, nearly half of the annual target of 1.80 million vehicles.

Therefore, Tesla’s current sales loss to BYD does not mean that it will always lose in the future. And BYD’s current dominance in the industry by relying on the "pure electric + hybrid" route does not mean that when pure electricity dominates the market in the future, it can still continue to dominate one side.

For automakers whose core selling point is the fuel tank, there are not many good days left.

If you have any objections or complaints about this manuscript, please contact tougao@huxiu.com

End

The original title: "The tram sells well, relying entirely on the fuel tank."

Read the original text

The guide price of Extreme Yue 01 is 219,900-309,900 yuan, and the guide price of Extreme Krypton 001 is 269,000-329,000 yuan. From the price level, the price of Extreme Yue 01 is slightly lower than that of Extreme Krypton 001. The 2025 Extreme Yue 01 is divided into three versions, namely the MAX version of 219,900 yuan, the MAX long-life version of 249,900 yuan and the MAX performance version of 309,900 yuan; The 2025 Extreme Krypton 001 is divided into five versions, namely, 259,000 yuan WE 95kWh rear-drive version, 269,000 yuan WE 100kWh rear-drive version, 269,000 yuan WE 95kWh four-wheel drive version, 299,000 yuan ME 100kWh four-wheel drive version and 329,000 yuan YOU 100kWh four-wheel drive version.

The guide price of Extreme Yue 01 is 219,900-309,900 yuan, and the guide price of Extreme Krypton 001 is 269,000-329,000 yuan. From the price level, the price of Extreme Yue 01 is slightly lower than that of Extreme Krypton 001. The 2025 Extreme Yue 01 is divided into three versions, namely the MAX version of 219,900 yuan, the MAX long-life version of 249,900 yuan and the MAX performance version of 309,900 yuan; The 2025 Extreme Krypton 001 is divided into five versions, namely, 259,000 yuan WE 95kWh rear-drive version, 269,000 yuan WE 100kWh rear-drive version, 269,000 yuan WE 95kWh four-wheel drive version, 299,000 yuan ME 100kWh four-wheel drive version and 329,000 yuan YOU 100kWh four-wheel drive version.

Respectively, the extreme krypton 001ME 100kWh four-wheel drive version has a maximum power of 580kW, CLTC pure battery life of 705km, and zero-hundred acceleration of 3.3 seconds, which can also be regarded as the first echelon in driving experience, so the extreme krypton 001 is not particularly outstanding in intelligence, and focuses on driving experience. Although it is a pure electric SUV, the Krypton 001 can also give you a driving experience comparable to that of an oil car.

Respectively, the extreme krypton 001ME 100kWh four-wheel drive version has a maximum power of 580kW, CLTC pure battery life of 705km, and zero-hundred acceleration of 3.3 seconds, which can also be regarded as the first echelon in driving experience, so the extreme krypton 001 is not particularly outstanding in intelligence, and focuses on driving experience. Although it is a pure electric SUV, the Krypton 001 can also give you a driving experience comparable to that of an oil car.